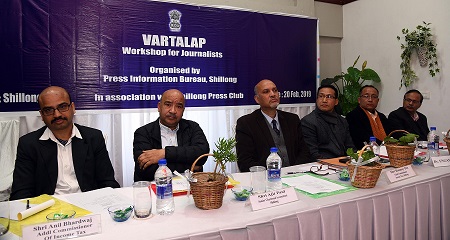

SHILLONG, FEB 20: Press Information Bureau, Shillong today organized a one-day workshop for journalists, Vartalap at Shillong Club in association with Shillong Press Club.

SHILLONG, FEB 20: Press Information Bureau, Shillong today organized a one-day workshop for journalists, Vartalap at Shillong Club in association with Shillong Press Club.Das appreciated the efforts of Press Information Bureau and Shillong Press Club in organizing sensitization workshops for journalists and said that the success of any scheme or policy of the government depends upon proper dissemination of information to the masses. In his address he also referred to the ongoing dedicated publicity campaign of the Income Tax Department, North East Region (NER) regarding income tax obligations of people in the region.

He said that there is a general incorrect impression that all incomes of tribal persons / non-individuals such as partnerships, LLPs, companies etc., are exempt. In fact, it is only the income earned in the scheduled area by such tribal persons, which is exempt. Incomes of all entities other than individuals, and incomes of tribal persons outside scheduled areas, are subject to Income Tax. Shri Das said that this workshop will help to make the people aware of such provisions.

Allantry F Dkhar, political adviser to the Chief Minister, Meghalaya lauded the efforts of Press Information Bureau in holding such workshops to make people aware of the policies and schemes of the government. He added that this kind of initiative will help in clearing the apprehensions of the tribal people regarding income tax. He also advised the Income Tax department to venture into awareness campaign in local languages as well for the tribal people.

Dr Engame Pame, Director, ROB, Shillong, hinting upon the importance of well directed communication, said that proper dissemination of information among the people is the essential for any scheme of the government to be successful. He added that a well informed Press also helps to clarify doubts among the masses regarding government policies.

During the technical session, Shri Anil Bhardwaj, Addl. Commissioner, Income Tax, gave a detailed presentation on the peculiar issues relating to Direct Taxation and on the issues related to section 10(26) of Income-tax Act with reference to Tribal areas.

He also highlighted various new provisions prohibiting certain types of transactions, particularly cash transactions, which attract stiff penalties. Since NER has low banking coverage, people may inadvertently enter into the prohibited transactions and thus become exposed to penal provisions, he added. He said, “The awareness campaign, and this workshop in particular will help the people understand and avoid such prohibited transactions”.

He also added that The Benami Transactions (Prohibition) Amendment Act, 2016 imposes obligations on taxpayers and others not to indulge in certain types of transactions or to report such transactions. This workshop seeks to spread awareness about such laws and prohibitions and obligations thereunder, he added. This is for the first time that such dedicated campaign has been launched in NER for the benefit of the tax payers in the Region.

The workshops was also attended by K.K. Tripathi, Joint Commissioner, Income Tax, Ajit Paul, Senior Chartered Account, officials of the Income Tax Department of Shillong and Guwahati, officials of Press Information Bureau, Guwahati and Shillong, and officials of the State government.

The technical session was followed by an interactive session where the resource persons were able to clarify various queries of the journalists.

By Our Reporter

+ There are no comments

Add yours